Today a travelling sales executive from Des Moines, Iowa, has the same knowledge and information in the palm of their hand that only the president of the United States did 20 years ago. Smartphones and tablets used to review our business trip details on now have more processing power than the Apollo moon landing spacecraft.

Computing power continues to double every two years – as defined by Moore’s Law – while prices continue to drop. This means that computers are being built twice as powerful but without costing twice as much as before every two years, and this law has already held good for 50 years. Technology today takes what used to be scarce and makes it abundant, over and over again. With knowledge and information so freely available, access to it is less costly and at the fingertips of billions of people the world over. Steve Jobs surely smiled at this particular ‘dent in the universe’.

Low-cost-entry for web-based digital technology coupled with software development cycles and lead times constantly reducing can only mean this accelerated exponential growth is set to continue. As a direct consequence expect a heady stream of disruptive innovation as a constant factor in almost every facet of our business and personal lives.

I’m repeating what plenty of industry commentators have expressed about technology-driven disruption, but focusing on a big shift being seen in the corporate travel sector. Step up disruptors like AirBnB and Uber that target a new generation of business travellers armed with smartphones who are getting more and more comfortable making their own buying decisions, often while on the move and sometimes contrary to their company’s travel purchasing policies.

But to what extent is this behaviour undermining companies with centralised corporate purchasing directives? Examining key trends on what people are actually doing starts to tell the story.

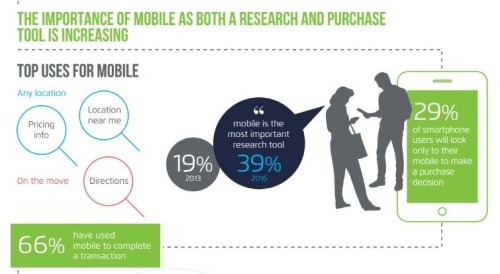

Recent research from xAd (a location-based mobile advertising tech company based in the UK) has shown that 29% of consumers admitted using a smartphone as the only tool they use to make purchasing decisions. And whatever happens in the consumer world soon enough surfaces in the business world too.

Note also that 56% of consumers buy immediately or within 1-hour after researching. The always on nature of mobile means more attention needs to be paid on how to engage and influence people at the right time and in the right place – wherever in the world they might be.

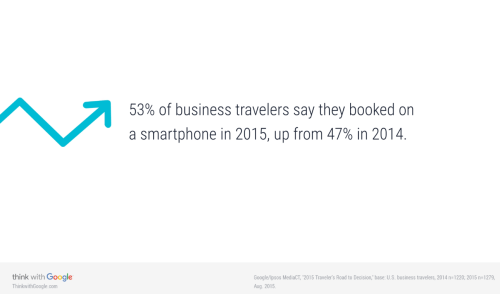

Drilling down into specific behaviour of business travellers, the trend is clear. Research from Google Ipsos Media on US travellers in 2015 shows that just over half booked travel on their smartphones.

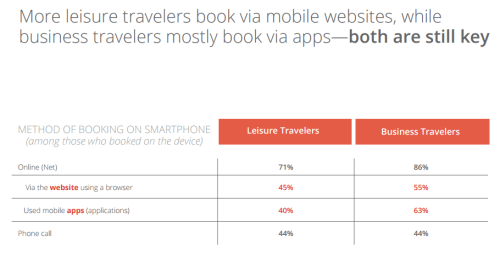

Interestingly too, US business travellers are more inclined to use travel apps on their smartphones to book travel – 63% of them compared to 55% who access a website via their smartphone to book travel.*

* Extract from Google Ipsos Media ‘2014 Traveler’s Road to Decision’.

A recently published GBTA (Global Business Travel Association) and Carlson Foundation study www.tnooz.com/article/business-travel-mobile has shown that despite the emergence of mobile travel apps around 2009 and the subsequent growth in usage by business travellers, TMCs (Travel Management Companies) and their corporate clients haven’t responded sufficiently or quickly enough to this behavioural shift.

The study highlights that 69% of ‘Travel Professionals’ admit that their programme doesn’t have a mobile strategy in place. Although, most to plan to do so within the next 2 years – 64% of respondents, with another 24% saying they’ll devise a strategy in the next 3 years.

With the growing number of business travellers using smartphones for travel purchases, getting service messages and updates directly from travel suppliers, like airlines and hotels, and using various apps to find their way around a new business destination, it would seem that their company’s travel department and TMC need to apply more haste on this issue.

If not, this generally widespread hesitant approach risks undermining corporate purchasing policies and programmes designed to support an organisation’s business goals while minimising travel-related spend and achieving desired levels of productivity from employees travelling on business.

Or in the future, will organisations just trust their travelling executives to do the right thing – using whatever mobile technology offers to make the right travel buying choices?